Factoring is a process that provides your business with up to 90% of the gross invoice value, normally within hours of you raising the sales invoice to your client (receiving the remaining 10% when your client pays). In certain cases some lenders will advance as much as 95%!

In simple terms, you raise the invoice, upload it to the lender’s portal and then request the amount of money you require. Some lenders will give you a choice of them undertaking the credit control or you administering it yourself. Once the invoice gets paid, the remaining balance becomes available to you.

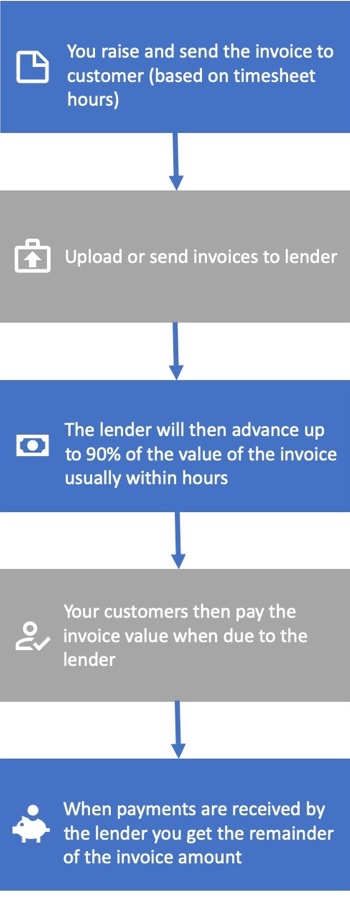

The basic process is outlined in the diagram below: -

1 - You raise and send the invoice to customer (based on timesheet hours).

2 - Send or upload invoices to the lenders portal.

3 - The lender will then advance up to 90% of the value of the invoice usually within a few hours.

4 - Your customers then pay the invoice value when due to the lender.

5 - When payments are received by the lender you get the reminder of the invoice amount.

Most factoring facilities have the option to add bad debt protection should you wish to protect against your customer not paying or going into administration (different terms apply).

Click here to get your factoring quotes

Most facilities have the option to add bad debt protection should you wish to protect against your customer not paying or going into administration (different terms apply). Ask us for more information.

Find out more

Why do recruitment agencies

use invoice factoring?