Cash is absolutely key when setting up or growing a recruitment business. Over the last 5-10 years, we have seen more and more recruitment businesses utilise invoice finance products to release money from their outstanding permanent placement invoices.

We have a number of different suppliers that offer this facility and although the up front percentage of funding can be different between lenders, some offer up to 100% of the permanent invoice value as soon as the candidate has started. Sometimes if agreed in your terms, lenders pay on acceptance or a retained or staged invoice.

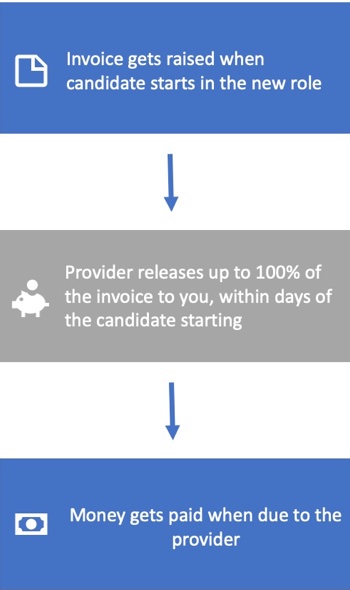

Depending on the lender, the process may be slightly different however below shows a guideline of how it could work

The basic process is outlined in the diagram below: -

1 – You place a candidate into a new role.

2 – Invoice gets raised on day one of the candidate starting.

3 – You get up to 100% finance from the provider.

4 – The money gets paid to the provider when due.

Permanent finance can also, if required have the option of bad debt protection; some lenders even include it in the cost.

Click here to get your Permanent Funding quotes.

With almost a decade of experience in providing factoring, invoice discounting and payroll back office funding solutions solely in to the recruitment market, we are more than just a quote generator and are always available to give impartial advice throughout.

Find out more about us

Complete our free quote tool or contact us today, or if you would prefer to speak out of working hours this can easily be arranged.

01600 735003

01600 735003“Compare Recruitment Factoring hold a wealth of knowledge & experience within the recruitment finance sector, they are excellent to deal with,

extremely honest and helpful. I would not hesitate to recommend compare recruitment factoring to anyone with recruitment finance requirements.”

Stuart - Existing Commercial and Industrial Recruitment Business